I know that some of you don’t want to hear this…but I have to tell you that crypto is back.

It is my job to follow the data and trends in finance and explain what is going on to my financial coaching clients.

It is not my job to push product. I don’t believe in just one asset class. There are no “good” or “bad “asset classes, there are just different tools for different jobs.

The right price can make any asset class a good opportunity and the wrong price can make any investment a bad one.

I do like to think of low cost equity index funds as the healthy “base layer” of a portfolio…just as whole foods (fruit, vegetables, meat, fish, nuts etc) should be the healthy base layer of your diet.

But is still room for the occasional deviation from a strict diet. Everything in moderation.

Question: What do Bogleheads and Bitcoin Maximalists have in common?

Answer: They are both financial cults.

Bogleheads are proponents of low cost buy & hold equity index investing. They (or rather we) believe in dollar cost averaging into index funds and holding forever. Their founder-leader was Jack Bogle, who started Vanguard, the index-investment manager.

Bitcoin Maximalists are proponents of Bitcoin as the one true cryptocurrency that will replace much-despised fiat currencies (e.g. $/£/€) with the libertarian dream of hard money that can not be printed and manipulated by governments.

Ironically, both these cults kinda have a point…even if membership of the 2 groups is mutually exclusive.

A cult is a group or tribe of people bound together by a set of beliefs that members “sign up” to.

A cult can be religious, political or ideological. The internet now allows almost any belief system to form, self-organise and get a cult following.

Here are the characteristics of any cult :

a charismatic leader

a set of beliefs explained with a specialised vocabulary

a status hierarchy with levels of achievement

a sacred text

expulsion of apostates

aggression against "near-believers" ('this is the temple I do NOT belong to)

arcane rituals

It is interesting that cults focus most of their energy on near-believers rather than non-believers.

A near-believer is a threat if they take other cult members with them and away from the cult. A near-believer is more likely to be capable of bring turned and bullied back into the fold. A non-believer is less of a threat and not worth as much attention.

When I started writing about financial independence in 2014, I hadn’t realised that I’d joined a cult.

There wasn’t an application form and there wasn’t a government health warning anywhere in sight.

I only found out that I’d joined a cult when I got feedback from the internet. It turned out that I was only “allowed to” write about some things and not others.

The Bogleheads were not happy when I started writing about crypto.

Here some nuance is required.

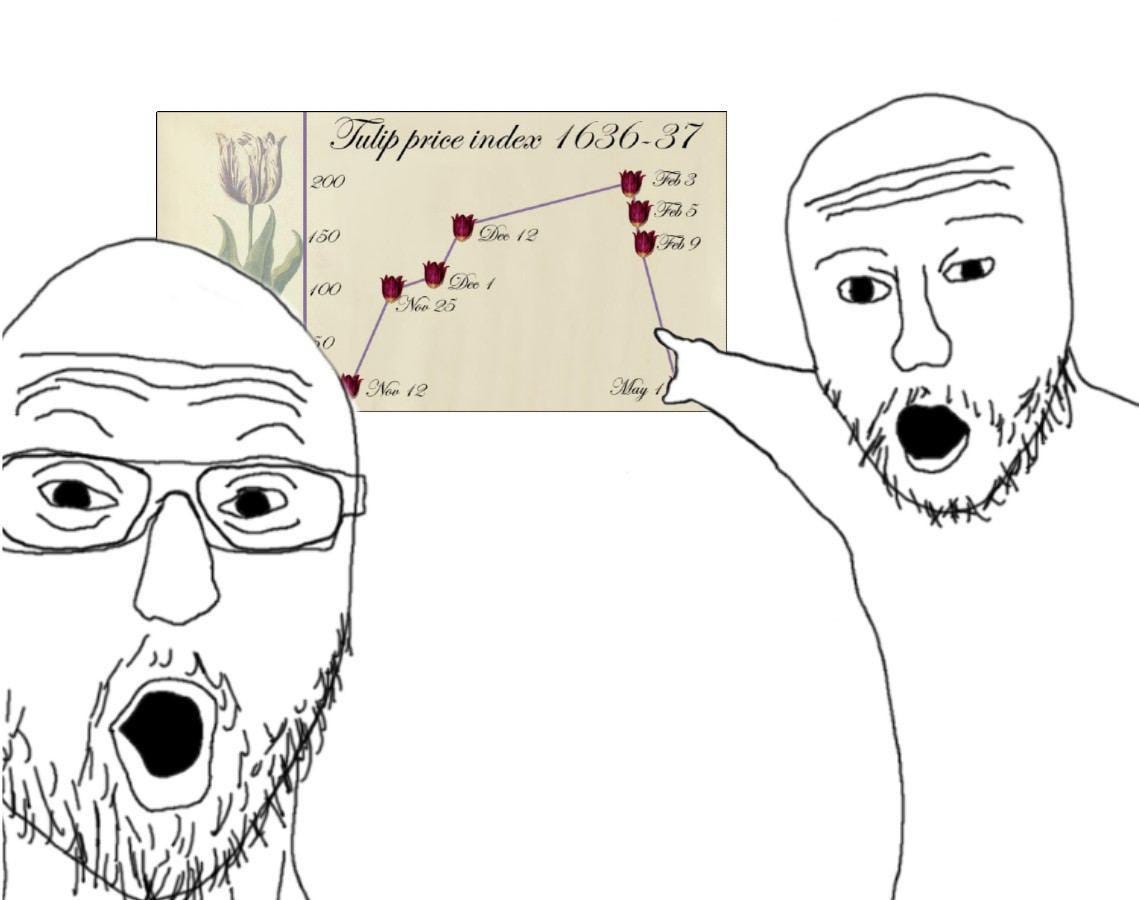

It is perfectly correct to say that crypto prices exhibit extreme volatility with booms and busts and crazy risk taking by inexperienced / greedy / naive participants.

But that does not mean nothing of substance is being built in crypto. Crypto financial applications run on software and no one would say that software companies such as Oracle, Microsoft, Google etc have no value because they “only” create software rather than physical products.

I went deep down the crypto rabbit hole in 2021 and found that what was at the bottom was much more interesting than just a speculative frenzy.

Contrary to first appearances, crypto does offer the ability to invest in productive assets. And it’s possible to be a sensible long term buy and hold investor in crypto.

But to do this, you need to:

have a target asset allocation

“ring fence” part of your portfolio

understand what you are doing

have conviction

ride the extreme volatility (and not get shaken out)

have an investment timeframe and exit trigger(s)

Crypto is a hard asset class to own…even when you get the asset selection right.

Ironically, owning some crypto made me a better equities investor as it increased my psychological ability to tolerate big drawdowns.

In the stockmarket, when there’s a 30% fall they call it “Black Monday” or something equally dramatic. In crypto, it’s just Monday.

I use these weekly(ish) emails for two things.

Firstly, they are intended to be useful financial education (as well as entertainment). But they are also to let people know what I am up to.

Money is just a tool to get the life that you want..and “The 3 Legs of The Stool” of a Good Life are health, wealth and relationships.

So I now have a separate Substack blog for each of these 3 legs:

Love to everyone

Barney