Today we pay our respects to the late, great Charlie Munger.

My favourite Mungerisms are:

1: On compound growth

“The first rule of compounding is to never interrupt it unnecessarily”

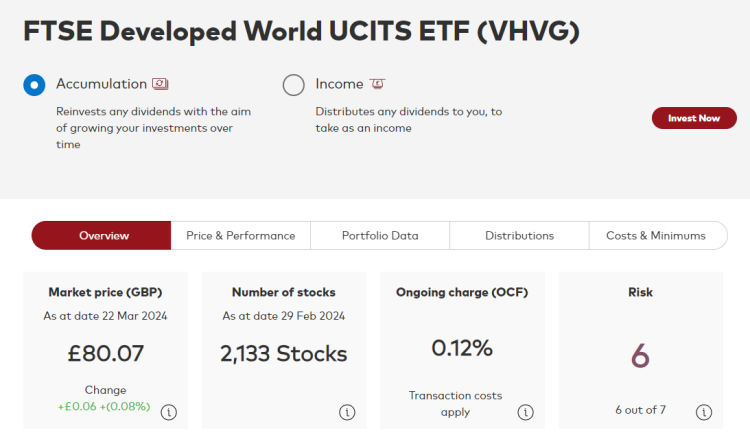

The implication here is to manage your own portfolio, buy a slice of the economy via the stockmarket and hold it forever.

I hear some people asking: How would you do something complicated like that?

Wrong question : It’s really not that complicated.

2: On incentives

“Show me the incentives and I will show you the outcome”

Humans respond to incentives.

If crime didn’t pay, there would be a lot less of it.

If lying to the public didn’t win elections, then politicians would stop lying.

If you bail out the banks every time they blow up the financial system, they will probably keep blowing up the financial system (despite moar regulashun).

If you pay fund managers and financial advisers a % of funds under management, they will try to gather more funds under management.

I could go on…but hopefully you get the idea.

3: On Bitcoin

“Bitcoin is almost as bad [as] trading freshly harvested baby brains”

This one is a zinger. It’s so good I had to google it and check that he did indeed say this (he did). Munger also said:

When Bitcoin was trading at $150 in 2013 (credit for being early to the party): "I think it's rat poison"

Five years later in 2018 when BTC was trading at $9,000: "So it's more expensive rat poison"

In 2022 when Bitcoin fell below $3,500: "I'm proud of the fact that I avoided it. It's like some venereal disease. I just regard it as beneath contempt"

In 2023 when Bitcoin hit $45,000 : "I call it crypto shit. It's worthless, it's crazy, it's not good, it'll do nothing but harm, it's antisocial to allow it… I think the people that oppose my position are idiots"

JEEZ : GET OFF THE FENCE CHARLIE WHY DON’T YOU?

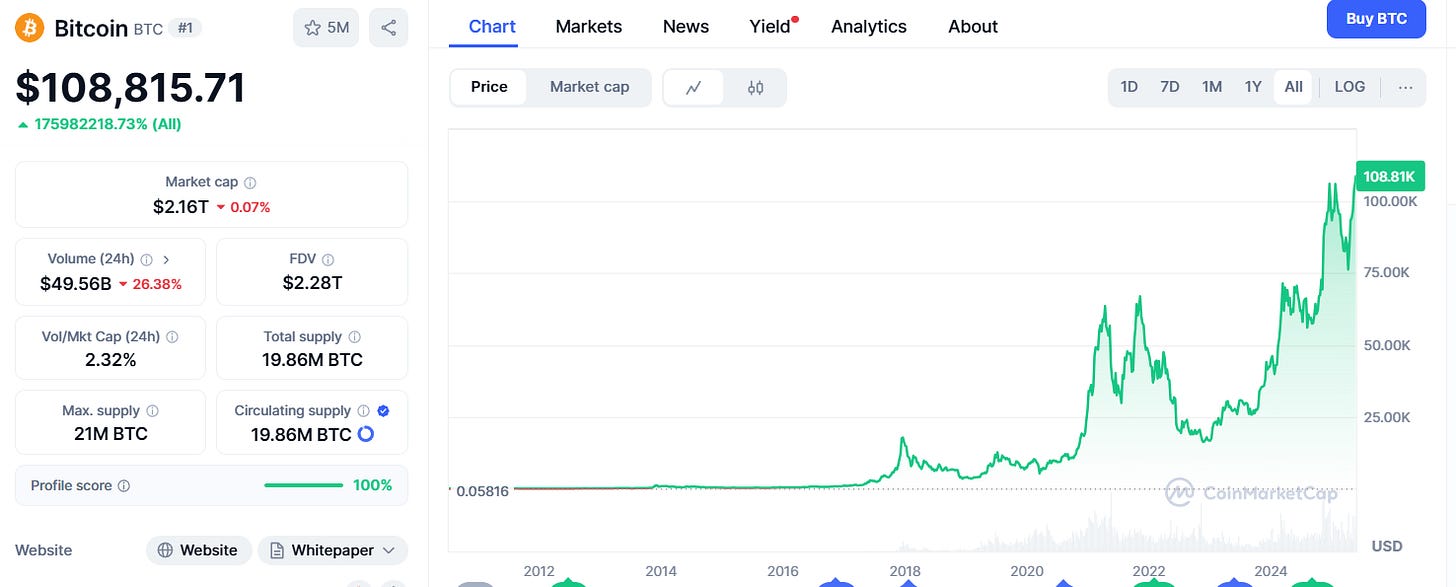

The Bitcoin price hit a new all time high this week and is currently trading around $108,000 per token. That’s a market capitalisation of $2.6 trillion.

Whilst he was right about a LOT, Munger may not have been right about Bitcoin.

Or maybe he was…the jury is still out.

It has been said that owning Bitcoin is like winning the lottery in slow motion. It’s certainly been like that thus far.

Bitcoin has compounded at 143% per year in the period 2011 - 2025:

Now <that’s> compounding.

Whether Bitcoin (or some version of it) continues to be the slow motion lottery win it has been in its first 16 years of existence remains to be seen.

Apart from the whole “freshly harvested baby brains” critique, other arguments against bitcoin / cryptocurrency include:

“It will never work”. It already does

“It’s used by drug dealers and criminals” The US dollar is the number one currency for drug dealing. 90 percent of U.S. bills carry traces of cocaine

“It’s backed by nothing”. indeed…as is the current (fiat) system

“It will get shut down”. It’s 16 years in and it hasn’t been

“It will get regulated out of existence”. Bro, Trump just issued his own shitcoin (max grift) and replaced the head of the SEC with a Crypto-Mom

“You don’t need it” You might do some day…but maybe you don’t realise it yet. Ask someone in Zimbabwe

There are some good arguments that can be made against Bitcoin and other digital assets (most of which are scams / jokes / memes).

I have concerns about the inequality of the distribution of the coins (I don’t have enough).

I have concerns about the future Bitcoin security budget (will transaction fees be enough for miners after the next couple of issuance halvings?)

I have concerns about what happens as quantum computing advances.

I have concerns about the electricity usage of proof of work.

I could go on but hopefully you can see that there are valid arguments on both sides of this debate.

Go ahead and call me a Cryptography Brother if you want but the dumbest anti-crypto argument of all is the one favoured by politicians, Shills For The Regime, personal finance simps and Boomers.

The dumbest argument of all goes like this:

“we don’t need crypto because the current financial system works perfectly well”

I hate to be the one to break it to you but the current financial system does not work perfectly well for everyone.

It is not all good in the hood.

If you are in your 20s or thirties living in the UK or USA or Australia or Canada or wherever and you can’t afford to get on the housing ladder, the current financial system is not working for you.

Money-printing in the current system drives asset price inflation. Demand & supply dynamics (the lunacy of open borders plus planning regs) just makes this worse.

I’m all for frugality but it is borderline cruelty to tell Gen Z that if they work hard and save into their cash ISA every year, they will be able to buy a house…let alone ever achieve any sort of financial independence.

If you understand the history of fiat currencies, then you may be less interested in being a lottery winner and more interested in not being financially wiped out.

The UK public finances are bleeding out. In a new twist on “The Art of The Deal”, Starmer has come up with a new version of privatisation where we pay other countries to give them our national assets (e.g. The Chagos Islands). Genius.

In the USA, the one trillion dollar per year debt interest bill now exceeds the military budget. Meanwhile, the much hyped DOGE project has been stood down.

There is zero prospect of fiscal discipline in The West until something breaks (and breaks hard) in The System.

In the meantime, bonds will stay in a perpetual bear market. As Voltaire put it:

Paper money always returns to its intrinsic value - zero

If you live in a world where the government prints ~8% new M2 base money every year (HINT: YOU DO) trying to save your way in cash to being rich => NGMI.

The cost of sitting in cash is not ~2% inflation, it's the ~8% annual rate of money-printing (the difference is explained here).

In a world without money-printing, inflation would be negative and the cost of living would be falling.

Beyond the classic emergency fund, surplus cash is trash and bonds too are trash. “Your age in bonds” = retardation. 60% equities : 40% bonds is a Boomer meme.

If you want to protect and grow your wealth, you are going to have to at least consider hitherto unconventional approaches to your finances.

There is no good path that does not involve learning to understand alternative asset classes and living with asset price volatility.

Buffett and Munger were nothing if not intellectually flexible.

They learned as they went along and they changed their strategy to adapt to changing conditions.

Much of the Buffett / Munger fanboy coverage paints them as The Patron Saints of American Business.

That’s a nice story but in their earlier days they were basically hedge fund managers who dabbled in alternative asset classes and played dirty hard in precious metals.

According to Grok: In the 1950s and 1960s, Warren Buffett, through his Buffett Partnership fund, sought to corner the physical silver market. He anticipated price rises due to limited supply and industrial demand. His partnership bought millions of ounces, but the strategy faced logistical hurdles, including storage costs and concerns about market manipulation. Regulatory scrutiny and the risk of government intervention loomed large, as cornering attempts could destabilize markets. Buffett eventually sold his holdings in the mid-1960s, achieving modest profits.

My guess is that if Buffett and Munger were young non-billionaires in 2025, they would be open minded: potential Cryptography Brothers rather than Rat Poison Shamers.

Love to everyone

Barney

If you’d like to discuss financial coaching or career coaching, you can set up an introductory call with me here.

Please share this email with anyone you think could benefit…thank you!